All of us know that the Central Government of India fixed the Deadline of Aadhar Pan Link on 30th June 2023. Many people have completed the process and if any one is left then he or she should follow the How to Link Aadhar with Pan Step by Step Instructions given below, It is to inform you that if anyone failed to Link Aadhar Pan Card Online then their PAN Card will become inoperative from August 2023. After that, you will not be able to perform financial transactions and many other penalties will be levied. Moreover, if you have completed the process then kindly Check Pan Aadhar Link Status @ incometax.gov.in and see if your verification is done or not. As per the requirements, you should have Pan Card, Aadhar Card and Mobile Number to complete the Aadhar Card Pan Card Link. Readers can get to know about the complete details such as penalties if the linking is done and incometax.gov.in Aadhar Pan Link Status Check. You can tap on the link given below and check your Aadhaar Pan Status using the Mobile Number or aadhar Card Number.

Pan Aadhar Link Online

As we know, the Government of India has mandated the Linking of Aadhar Card and PAN Card so all of you must do it right now otherwise it will be very complicated for you. It is to inform you that the Last Date for Pan Aadhar Link was 30th June 2023 and all those who have not completed the process will get their PAN Card Disabled. If you failed in completing the process then you should immediately link your PAN and Aadhar Card by paying Fine of Rs 1000/-. Any citizen who fails to do so will not be able to perform cash transactions or financial transactions. So make sure you complete the process right now to be eligible for Banking and other Cash Transactions. This linking is very important because it will become easier for the Taxpayers to pay their Taxes and to do other similar transactions. If you do not link your Pan Aadhar Card then you will be debarred from paying taxes in future and you will not be able to do any financial transaction through Bank or through Cash.

Aadhar Pan Card Link Last Date @ Incometax.gov.in

| Department | Income Tax Department |

| Service | Aadhar Card Pan Card Link |

| Documents Required | Aadhar Card, PAN Card, Mobile Number |

| Aadhar Pan Card Link Last Date | 30th June 2023 |

| Mode of Process | Online |

| Aadhar Pan Card Link with Late Fee | Open now |

| Penalty Amount | Rs 1,000/- |

| Pan Aadhar Link Status | Check online |

| Benefit of Linking | Ease in Tax Payment and Financial Services |

| Type of Article | Latest News |

| Income Tax Aadhar Pan Link Website | Incometax.gov.in |

Pan Aadhar Link Status Check on Incometax.gov.in

All those who have Linked their Aadhar and Pan Card should do the Pan Aadhar Link Status Check on the official website. Once the Department confirms that your linking is complete then you should stay tension free. If you have recently Linked aadhar and pan card then you have to wait for 1-2 Days so that verification is complete and then you can check the status. Simple Instructions are given below which you can perform to Check Aadhar Pan Link Status @ incometax.gov.in. Simple Details such as PAN Card Number, Aadhar Card Number and Mobile Number has to be used on incometax.gov.in Pan Aadhar Status Link given below. After that, you will be able to know whether your application is approved or not and if it is approved then you should take the screenshot and keep it with you for further reference.

Documents Required for Pan Aadhar Link

All the Tax Payers in India Should check the List of Documents Required for PAN Aadhar Link @ incometax.gov.in. All of you should have these documents in hand and then only you should proceed for the linking process. Moreover, we have also mentioned the instructions below which you can follow to complete the linking process.

- Aadhar Card Number.

- Pan Card Number.

- Registered Mobile Number.

Incometax.gov.in Pan Aadhar Link Status : Instructions

- All of you can follow the instructions given below to Check Pan Aadhar Link Status.

- Go to incometax.gov.in from the device.

- Now select the Home button and then select the Aadhar Pan Status Link.

- Enter your Aadhar Number or Mobile Number and tap on the submit button.

- Enter the OTP and check your Linking status on this page.

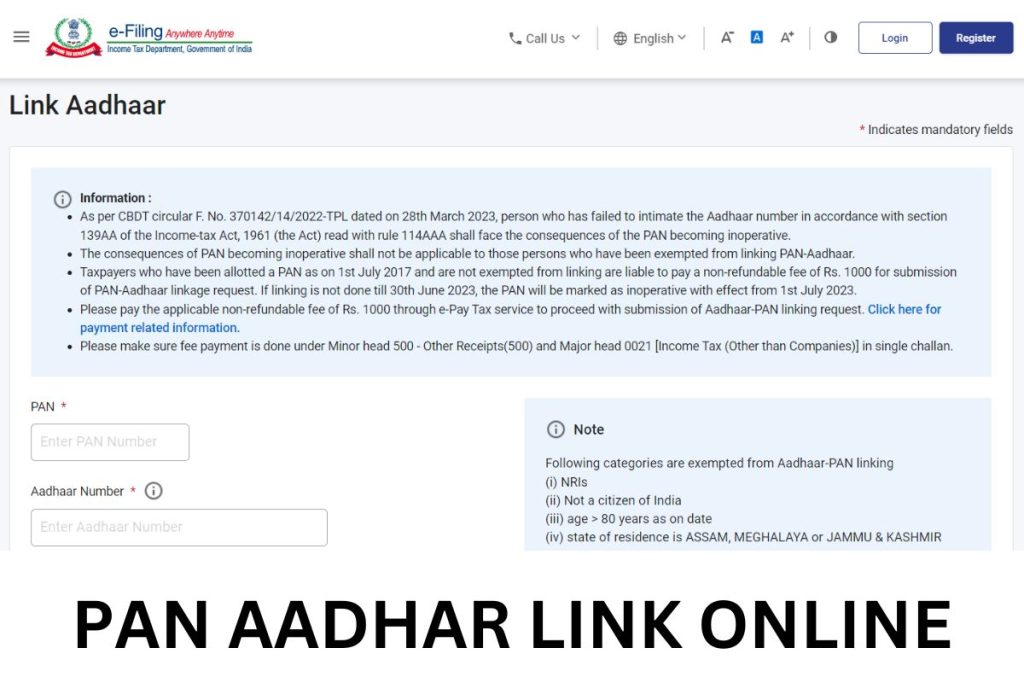

How to Link Aadhaar with Pan Online Step by Step @ Incometax.gov.in

- Following Instructions will help you to Link Aadhaar with PAN Online Step by Step.

- Go to incometax.gov.in and select the home button.

- Now select the Aadhar Pan Link button.

- Enter your Aadhar Card Number and Pan Card Number.

- Submit the Request and then enter the mobile number.

- Enter the OTP Received and proceed.

- Pay the Penalty Fees through Online Banking and complete the process.

Penalty for Not Doing Aadhar Pan Link

- Following is the List of Penalty for Not Doing Aadhar Pan Link.

- You will be debarred from Financial Transactions and Cash Transactions.

- Your Pan Card Number will be removed and you cannot pay taxes.

- Moreover, you will not be eligible for any kind of Bank Loan.

- So make sure you complete the process to avoid these penalties.

Incometax.gov.in Aadhar Pan Link Status Check

| Aadhar Pan Link Online | Check Link |

| Pan Aadhar Link Status Check | Check Link |

Frequently Asked Topics on Pan Aadhar Link

When was the Last Date for Pan Aadhar Link?

Last Date was 30th June for Aadhar Pan Link.

What is the Penalty for Late Taxpayers who are linking now?

You need to pay Rs 1000/- as Penalty for doing delay in Aadhar Pan Link.

On Which Website is Aadhar Pan Link available?

You can go to incometax.gov.in to Link your Aadhar Card with Pan Card.

Hi, i am Krishna Iyer an incredibly talented educational content writer hailing from India. I always had a passion for education and a deep love for writing with a natural curiosity and a thirst for knowledge, which led to a keen interest in various academic subjects. I obtained a degree in English literature. With a strong educational background and a passion for writing, I embarked on a career as an educational content writer. They have since worked with various educational institutions, creating engaging and informative content for students of all ages. My writing style is known for its clarity, creativity, and ability to simplify complex ideas, making learning a joyful experience for students.